Until fairly recently, the total South African peanut industry was controlled by the RSA Peanut PlantOilseeds Board. Due to food shortages after the 2nd World War, the South African Government launched a campaign to stimulate the production of Groundnuts. The state provided farmers with loans under "interesting conditions". This enabled farmers to purchase seeds and to plant a crop, which in turn they would be able to sell again at guaranteed prices. This single marketing system thus ensured complete control by the RSA Oilseeds Board.

MEX ORGANIC Runner 40/50– USD 3.000,00 Shipment July 2025 / per MT / C&F RDAM

Shipment July 2025 / per MT / C&F RDAM

CHI Organic hsuji 40/50 – USD 2.600,00 Shipment July 2025 / per MT / C&F RDAM

Shipment July 2025 / per MT / C&F RDAM

ARG Runner 38/42 BL – USD 1.450,00 Shipment July 2025 / per MT / C&F RDAM

Shipment July 2025 / per MT / C&F RDAM

ARG Runner BL splits – USD 1.325,00  Shipment July 2025 / per MT / C&F RDAM

Shipment July 2025 / per MT / C&F RDAM

ARG Runner 38/42 – USD 1.275,00 Shipment July 2025 / per MT / C&F RDAM

Shipment July 2025 / per MT / C&F RDAM

USA jumbo runner 38/42 – USD 1.500,00 Shipment July 2025 / per MT / CIF RDAM

Shipment July 2025 / per MT / CIF RDAM

USA JBO Runner blanched – USD 1.675,00 Shipment July 2025 / per MT / CIF RDAM

Shipment July 2025 / per MT / CIF RDAM

USA ORGANIC Spanish 50/60 – USD 3.300,00 Shipment July 2025 / per MT / C&F RDAM

Shipment July 2025 / per MT / C&F RDAM

Birdfeed any origin 60/70 – EUR 1.175,00  Shipment May 2025 / per MT / C&F RDAM

Shipment May 2025 / per MT / C&F RDAM

ARGENTINE PEANUT INDUSTRY

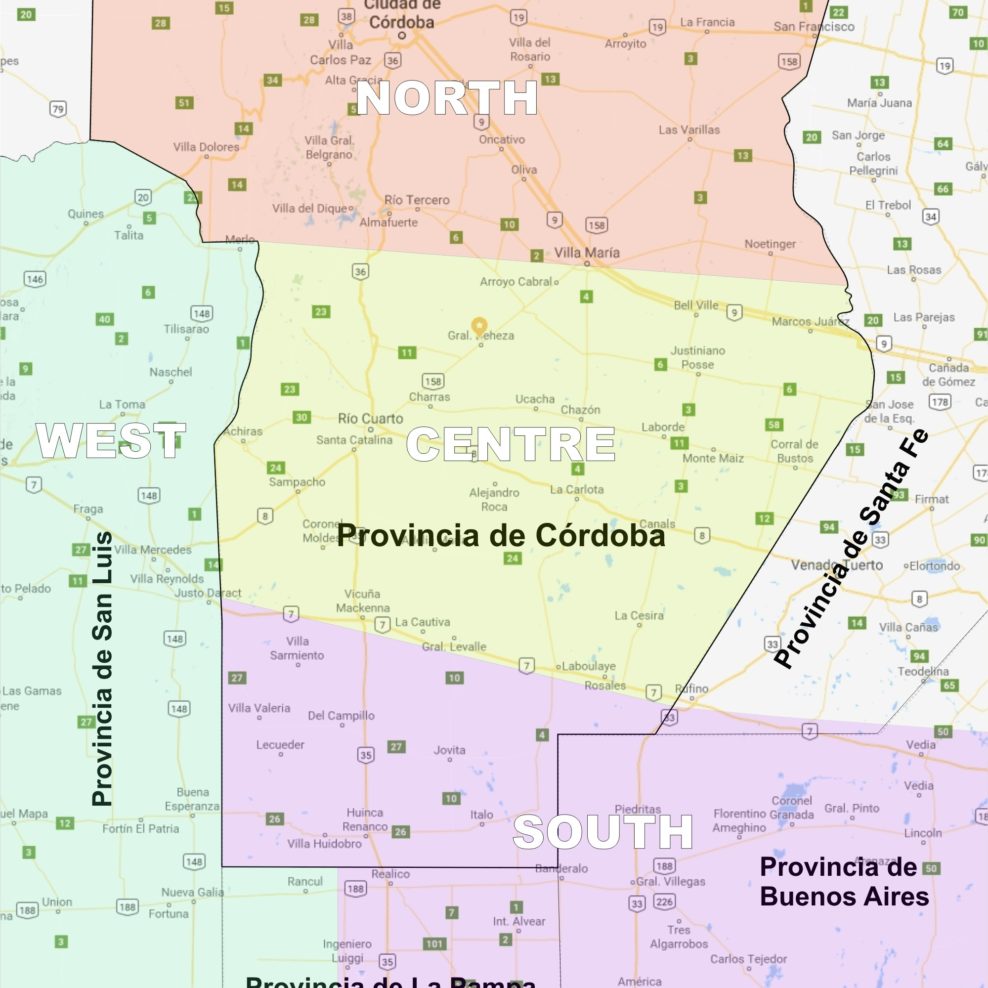

Argentina has an abundance of land suitable for production of peanuts, with a high soil fertility that generally requires no fertilizers to produce large and good crops. Most of the peanut planting and production however, is concentrated in the areas: Province of Cordoba and General Deheza, jointly forming the Argentine peanut belt. Besides peanuts, most of the Argentine farmers also have the possibility to grow Corn and Soybeans.

Argentina usually plants its peanut crop around October.

Latest news

- Breaking news South Africa, of... -- November 30, 2023Breaking news South Africa, la... -- November 17, 2023Breaking news: new peanut crop... -- November 7, 2023Egypt: breaking news -- August 13, 2023Bio-certification Bohemia Nut ... -- April 19, 2023Latest peanut forecast South A... -- March 31, 2023Argentina: 2023 crop, surprise... -- February 28, 2023South Africa, mixed -- February 22, 2023South Africa, bullish -- February 10, 2023Brazil harvesting delayed, bul... -- February 10, 2023